Latest Update (New York time 1:48pm): Markets show signs of recovery with S&P 500 at 5,108.23 (+34.15, +0.67%) and NASDAQ Composite at 15,736.81 (+149.02, +0.96%), while Dow Jones Industrial Average remains down at 38,177.88 (-136.98, -0.36%). Trading volume remains high with 3.788B shares for S&P 500, 930.864M for Dow, and 6.564B for NASDAQ. Both S&P 500 and NASDAQ have turned positive after earlier losses.

“Another 20% Drop”: BlackRock CEO Sounds the Alarm

BlackRock CEO Larry Fink warned that markets could plummet another 20% as Trump’s aggressive tariff policies take hold. The head of the $10+ trillion asset management giant stated that the U.S. economy is “probably already in a recession” and inflation pressures are significantly stronger than most investors realise. Despite the gloomy outlook, Fink described the market meltdown as “more of a buying opportunity than a selling opportunity” for long-term investors.

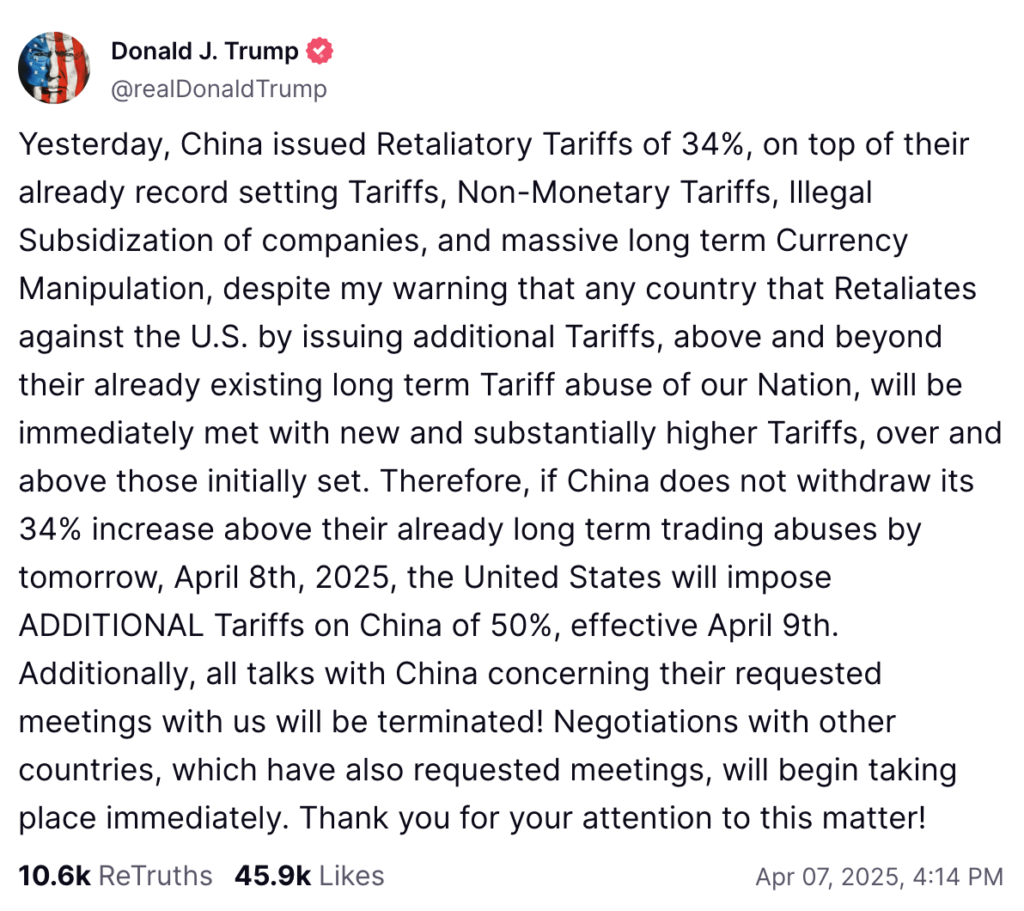

“50% More Tariffs”: Trump’s Monday Morning Bombshell

President Trump dropped a tariff bombshell on Truth Social Monday, threatening an additional 50% duty on Chinese imports if Beijing doesn’t withdraw the 34% tariffs it imposed on American products last week. Trump’s tariff escalation has been relentless: a 10% initial tariff, another 10% over fentanyl disputes, followed by last week’s additional 34% tariff (reaching 54% total). Monday’s threat would effectively double that burden, potentially pushing tariffs over 100% when combined with existing duties from his first term that Biden later increased to 100% for EVs and 50% for semiconductors.

“Fake News” False Hope Triggers Market Whiplash

Monday’s market session delivered whiplash-inducing volatility as investors briefly rallied on a report that Trump was considering a 90-day tariff pause. The relief was short-lived after the White House dismissed the report as “fake news,” sending traders back into panic mode.

The S&P 500 approached a 20% collapse from its February high – a stunning reversal from recent record levels. Asian markets suffered their worst day in years while European exchanges bled red.

“Economic Storm”: Oil Crashes 15% as Kremlin Sounds Alarm

Oil markets descended into chaos with Brent crude plunging another $1.61 (2.5%) to $63.97 per barrel – extending a 15% collapse over just four trading sessions. This oil price bloodbath, triggered by Trump’s tariffs and OPEC+’s surprise output hike, has shattered energy markets.

The Kremlin warned it would deploy all measures to shield Russia from what it termed a global “economic storm.” The crash threatens Russia’s ability to fund its Ukraine military operations – the nation’s most expensive campaign since the Soviet-Afghan war. Kremlin spokesman Dmitry Peskov described market conditions as “extreme turbulence” that is “tense and emotionally overloaded,” signalling potential intervention to stabilise Russia’s oil-dependent budget.

Global Leaders React with Alarm and Strategy

The European Union will begin collecting retaliatory duties on U.S. goods next week while seeking to negotiate a “zero for zero” deal. EU ministers prioritized negotiations over retaliation, with Dutch Trade Minister Reinette Klever urging a calm approach to “de-escalate” tensions.

Japanese Prime Minister Shigeru Ishiba called the tariff policies “extremely disappointing” during a call with Trump, highlighting Japan’s position as America’s largest foreign investor. Trump later described his tariff parameters as “tough but fair,” claiming Japan “treated the U.S. very poorly on Trade.”

Mexico’s President Claudia Sheinbaum stated that Mexico wants to avoid reciprocal tariffs, despite being targeted by auto tariffs. With 80% of its exports bound for the U.S., Mexico remains highly vulnerable to trade tensions.

Brazil’s central bank warned of “multiple layers of uncertainty” around whether tariffs will prove inflationary or deflationary, and how the Federal Reserve might respond.

Meanwhile, Trump welcomed the LA Dodgers to the White House, notably snubbing Democratic senators including California’s Adam Schiff and minority leader Chuck Schumer, remarking “We have a couple of senators here. I just don’t particularly like them” to laughter before moving on with other introductions.